The following post was originally written by me in October 2010, with some modifications for 2011 taxes. Please note that I am not an accountant or a tax expert. This is my understanding...

If you're anything like me, it's April and you haven't done your taxes

yet.

As any Celiac knows, a gluten-free diet can be very expensive. According to this article:

"Gluten-free foods, on average, cost a whopping 242% more than regular, gluten containing foods!"

The good news for my Canadian friends is there is tax deduction information listed on the Canada Revenue Agency site. In order to qualify for this, you MUST:

- have a note from your doctor stating that the diet is necessary AND

- save all receipts for gluten-free products purchased AND

- calculate the difference in cost between GF items versus regular gluten-filled items.

You may claim this "incremental cost" of your gluten-free diet. The CRA website includes a sample chart showing how to determine incremental cost. (Keep reading to completely understand what all of this means for you.)

I found this information about medical expenses on the CRA website:

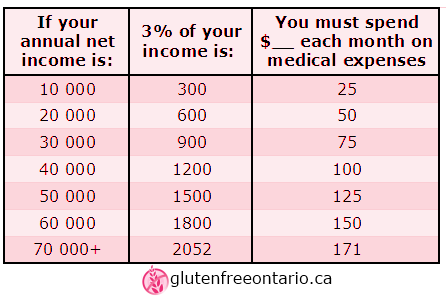

Only expenses in excess of the lesser of $2,052 (federal, for 2011) or 3% of net income can be claimed.

You are probably asking yourself, "But what does this mean?!"

Well, I decided to investigate further and let me show you, based on the 2011 tax year, my understanding of how this works...

You must spend over 3% of your net income (after taxes) annually in medical expenses. The last column in the chart above gives you an idea what that figure looks like per month so you can see how it compares to your monthly spending on gluten-free foods and other medical expenses.

If you have multiple people/dependents (kids) in the same household that must follow a gluten-free diet, or you have a lot of other medical expenses, it would probably be much easier to surpass the 3%. But you DO NOT get any credit for the initial 3%.

According to my friend Nikki, who is studying to be an accountant, you are entitled to a 15% credit on the amount above the 3% (or above $2052, depending on your income).

Example: In 2011, Mary's net income was $40000 and she spent $1600 on medical expenses (incremental cost of gluten-free food, dentist, prescriptions, etc). Three percent of her annual income is only $1200.

1600 - 1200 = $400

0.15 x 400 = $60

Mary would get a $60 tax credit.

I personally do not have the patience to keep all of my gluten-free receipts. Also, I do not have many other medical expenses so I really don't think I spend enough each month to make a claim

necessary.

What are your thoughts on the tax deductions for gluten-free medical expenses?

Have you filed a medical expense claim for your gluten-free diet? I would love to hear your experiences.

Although I have many allergies and intolerances, including an allergy to wheat, I don't qualify because it isn't celiac. It is kind of annoying because I do get very ill if I accidentally eat gluten, and I have some symptoms that are shared by celiacs as well (i.e. inability to absorb nutrients/vitamins). I know many might disagree with me, but I think they should extend this to those with a wheat allergy as well, as those with an allergy spend the same amount on gluten free products.

ReplyDeleteI totally agree. I'm in the same boat. It's costing me a fortune to eat GF/DF due to allergy/intolerances. There are more of us out there.

DeleteI just joined the GF/DF world 3 days ago and as Iam about to go to college, I am not looking forward to all these added expenses. I will keep my reciepts!

DeleteI'm thinking my husband (34 years old) might have a wheat allergy. Or is allergic (in the truest sense) to gluten itself (but not celiac). He had the blood test for celiac twice (over a period of a few years) and both times it didn't show any significant igA antibodies. He has been "sickly" since he was a child, had low vitamin D, constant heartburn since he was a teenager, random swollen joints in the last few years, pneumonia every year for the last 4 years etc). We finally just cut the wheat out and ALL his problems went away! He got pneumonia again just a few months ago (only about 6 months ago), but he bounced back within a few days rather than a couple of weeks of severe pneumonia with PLEURISY.

DeleteHe tried wheat again (einkorn) on Friday night because we thought maybe he reacts to the 33MER gliadin (that celiacs tend to react to) and einkorn doesn't have 33-MER gliadin. He woke up the next day with a swollen finger, and then at about noon he turned grey, started violently puking (and diarrhea) and went into complete shock. We called an ambulance and they brought him in because they said his blood pressure was low.

Anyways, I'm thinking it's a true wheat allergy. His joints also well up if he has Worcestershire Sauce (Canadian version has barley malt). He is going to see his allergist again and get her to do the skin prick test thing. Last time she wouldn't do it because she said that most foods aren't accurate with the skin prick test. Well I think he needs an epi-pen. The last experience was BAD. I have to cook from scratch to make GF products for him all the time. It seems unfair that only celiacs get the benefit when there are others that can't have wheat for different reasons!

I don't work..therefore we are a single income family..and apparently my hubby can't claim my expenses..but if I worked, making us a double income family with an increased household income, I could claim my expenses...STUPID!!

ReplyDeleteIf you are considered a dependent in your husband's income tax he can claim it. You need to file your taxes together. If you are using an accountant it will make it easier, just send in your medical forms etc with his and ask that they be filed together. They will know what needs to be done.

DeleteJax, I have heard that submitting the claim will likely trigger a personal review (audit) by the CRA. Even if you have done your taxes all correctly and have nothing to hide, the upheaval of an audit is something to consider. They may start investigating everything from your current year, back 7 years.

ReplyDeletePersonally, I find even having to do all the calculations and research as you pointed out above, to be enough to deter me from making any claim, never mind the risk of a review/audit.

As a person desiring a healthy lifestyle, I consume mainly fruits, vegetables and lean meat anyway, so the extra cost of the gluten-free bread products is not as big for me as it would be for someone who lives mainly on starchy foods.

Having said that, I think that there may be some people for whom the tax credit could be worthwhile. Thanks for the info!

Karen

I came to the same conclusion last year after saving as many receipts as I could. Then when I saw the whole table calculation, I was quite discouraged. I did a rough calculation, and yeah, I think it was maybe $50 I would get back if I put the time and effort into it.

ReplyDeleteHowever, I'm back to saving receipts again as my daughter was just diagnosed with Celiac Disease too, and our grocery bill is sky-rocketing. I asked my colleague in finance (who use to work at CRA) about her thoughts on claiming this as a medical expense, and she did make one good point...until the claims start coming in, the claim process won't be made easier.

I suppose, given the fact that the CCA fought really hard to make this a valid medical expense, we may want to give it our best effort to put forward our claims. The more people claim GF as a medical expense, the more the government will realize there's a significant need/demand, and maybe in time, it will be easier and much more beneficial.

Thanks for explaining that. I will talk to my doctor about a note. Anything that helps with taxes and expenses is awesome!

ReplyDeleteI just did my income tax return today, and I remember a few years ago my trainer at the gym told me that I can get a tax refund for all my G-F foods. I was so excited, until I discovered that it is only for those who have a Celiac diagnosis. I am gluten intolerant. My Dr. said that I could have the test to see if I am celiac, but that would mean going back to eating gluten for a month or so before being tested. Not only that but if the result shows negative I would have to foot the almost $500 bill! Errr.... no thanks. So if you can claim, I think you should.

ReplyDeleteHubby CAN claim your medical including your gluten free food if your have a medical note. I claim medical for my whole family

ReplyDeleteRegardless of the work, as I have just been diagnosed this year, I will definitely be filling out the forms and submitting them for the 2012 tax season. I say let the CRA audit me. I keep EVERYTHING - all receipts, etc. and can account for every last penny. Yes, I know...I am anal... My feeling is this: Why should the government even have one penny more if I am entitled to it. It is my money after all and I work extremely hard for it.

ReplyDeleteKeeping a spread sheet in Excel isn't difficult and every two weeks when I pay my bills, I just update the spread sheet. Come tax time, I just have to print it out. Even if this gets me $10.00 back, that money is mine.

the CRA website does not state you have to save all receipts, just A receipt to confirm the cost.See below:

ReplyDeleteWhat documents do I need to support a claim for the medical expense tax credit?

If you are filing a paper return, include the following supporting documentation. If you are filing electronically keep the following supporting documentation in case we ask to see them at a later date:

•a letter from a medical practitioner confirming the person suffers from celiac disease and requires GF products as a result of that disease;

•a summary of each item purchased during the 12-month period for which the expenses are being claimed (a sample summary is shown below); and

•a receipt to support the cost shown in column (4) of each GF product or intermediate product claimed.

It is expensive to live healthy today, you should get bigger tax benefits.

ReplyDeletewhat if you don't have any receipts

ReplyDeleteI have been diagnosed with celiac disease and because of this our food bill has increased significantly due to having to cook gluten free for the entire family. I do this so I can still feel like a member of this family when its time to eat.

ReplyDeleteCould I claim the increased costs based on my diagnoses ???

All of the documentation required to claim incremental price difference on gluten free products is readily available except where. Where can I find a list of average pricing, acceptable to CRA, in order to actually compare my receipts and calculate price differential.

ReplyDelete